How do Local Enterprise Offices help businesses financially?

Local Enterprise Offices (LEOs) can help to establish and develop new and existing enterprises provided that the enterprise is capable of becoming commercially viable.

There are also other criteria to be met and these are listed in the bullet points below.

The enterprise must:

- not employ more than 10 people;

- be established, registered, and operate within the area of the Local Enterprise Office;

- operate in the commercial field;

- show there is a market for the product or service;

- have the potential for growth in domestic or export markets; and

- have potential for job creation without affecting existing local business.

- Within the above criteria, there are certain priorities and restrictions.

For example, priority will be given to:

- Only enterprises in the manufacturing or internationally traded services sector which, over time, can develop into strong export entities and graduate to Enterprise Ireland.

- Unique tourism services enterprises that target generating revenue from overseas visitors; these tourism services should not displace business from other existing players in the market or give rise to deadweight (where projects would have proceeded anyway). Such unique tourism services may be offered salary supports.

- With regard to restrictions, retail enterprises, personal services, professional services or construction and local building services are not eligible for grant aid.

Type of Grants Available:

For more information on financial supports available from the LEO including information on eligibility, please see: www.localenterprise.ie

How do I apply for the grant?

If you want to apply for any of the above Grants, you need to contact your local LEO. They will assess your eligibility. Applications are considered on a case-by-case basis and the level of funding will be decided after the assessment.

The assessment will examine:

- The merits of providing grant support to your proposal;

- Your need for financial support;

- Any previous funding you have received;

- The availability of funding;

- The potential for employment and sales growth.

- Any individual or business who wishes to apply must submit a completed signed Grant application form along with the following:

- A CV (for the main applicant),

- Quotations for the key costs,

- 3 quotes for any item of expenditure over €5,000. (For any expenditure item costing less than €5,000, one verbal quote is required.); and

- The most recent set of certified accounts (in the case of existing businesses).

Application process

After you send in your application to Kilkenny LEO, we will write to acknowledge your application, and a business advisor from the Kilkenny LEO will meet with you to discuss the application. You may be asked to provide additional information. When we receive all the information we need, your

application will be evaluated at the next available meeting of the Kilkenny LEO’s Evaluation and Approvals Committee. You will then be informed in writing of the decision.

For a step by step process click here

PLEASE NOTE THAT YOU CANNOT USE YOUR GRANT TO PAY FOR ANY EXPENDITURE INCURRED BEFORE YOU MAKE THE APPLICATION.

The final decision

Also note that your submission of an application or the official acknowledgement of your application is not an indication that the application is eligible or will be awarded grant aid. The final decision on grant assistance is with the Evaluation and Approvals Committee of the Local Enterprise Office.

When can I access the grant funds?

If your application is approved, you can draw down your funding after you submit evidence of the expenditure detailed in your letter of offer. Also, any funding approved must be claimed within the time period on the letter of offer.

- To claim any financial assistance approved, you must submit the following:

- A signed acceptance of offer

- Original invoices

- Evidence of payment

- An auditor’s Certificate (if required)

- A claim form

- A current valid tax clearance certificate

- Any other documents as set out in the letter of offer

PLEASE NOTE THAT YOU CANNOT USE YOUR GRANT TO PAY FOR ANY EXPENDITURE INCURRED BEFORE YOU MAKE THE APPLICATION.

What is ‘De Minimis’ aid?

Business Expansion grants are provided under the European Commission Regulation on ‘De Minimis’ aid. De Minimis aid is limited amounts of State aid – up to €300,000 in any three-year period to any one enterprise. De Minimis aid is regarded as too small to significantly affect trade or competition in the common market. The amounts of grants are regarded as falling outside the category of State aid which is banned by the EC Treaty and, therefore, they can be awarded without reference to the European Commission.

However, a Member State must track De Minimis aid and make sure that combined aid payments from all sources to one enterprise in any three-year period respect the €300,000 ceiling.

Therefore, you need to provide details of all other grant aid that has been awarded to you or your company within the past three years. Please note that a false declaration to show a figure under the threshold of €300,000 could later mean that you would have to pay back the grant aid with interest.

What Supports Can Kilkenny Local Enterprise Office offer to small businesses?

Supports for small businesses PDF

How do I choose a legal structure for my business?

When setting up your own business, there are three possible structures you can choose to adopt:

Sole Trader

This is the most straightforward way to set up your own business.

- As a sole trader, you are the owner of the business

- You are legally liable for the business and do not have any protection if the business fails

- If the business is not successful, all of your assets (business & personal) can be used to pay off your creditors

Private Limited Company

- A legal entity, separate from its shareholders

- If the business fails the shareholders are only liable for any amount outstanding on the share capital they subscribe

Partnership- An agreement between two or more people to go into business together

- If the business fails, each partner is liable for all losses

- A ‘Deed of Partnership’ is usually drawn up outlining the obligations of each partner

Please note: it is highly recommended that you consult an accountant or solicitor before choosing an ownership structure for your business.

How do I register my business name?

You can register your business name with the Companies Registration Office (CRO). This can be done online at http://www.cro.ie/

How do I register my business for Tax and VAT?

All of the forms you are required to fill out are available to download on the website of the Revenue Commissioners at www.revenue.ie

How do I go about applying for financial assistance?

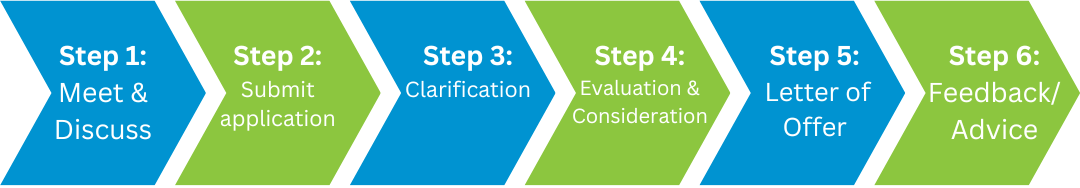

Our application process is straightforward and can be summarised as follows:

Step 1: Meet & Discuss

The project promoter arranges to meet with our Business Advisor to discuss their project proposal in detail. If your business proposal is one that may qualify for financial assistance, you will be requested to complete an application form and provide supplementary information and documentation. Our Business Advisor will explain exactly what is required.

Book an appointment with one of our business advisors here.

Step 2: Submit Application & Documents

A completed application form, along with all of the necessary support documentation is then submitted by the project promoter for review by the Business Advisor.

Step 3: Clarify all issues

Additional clarification or information may be sought by the Business Advisor.

Step 4: Consideration by the Evaluations Committee

The application is then submitted to the Evaluation & Approvals Committee for appraisal. This committee comprises members of the business community, financial institutions and local authority and they usually meet every six weeks. All documents relating to the application are submitted to the committee one week in advance of their meeting for consideration.

Step 5: Letter of Offer (If Approved)

The Head of the Local Enterprise Office (LEO) informs the project promoter in writing of the Evaluation & Approvals Committee's decision. In the case of grant approval, a formal letter of offer and terms and conditions attaching to the grant-aid will also be issued.

Step 6: Feedback/Advice

In the event of your project being deemed ineligible and/or not obtaining financial assistance from the Kilkenny LEO, you can discuss the project application and evaluation with us to obtain further feedback and/or advice regarding the application. If you are not satisfied, you will be provided with written notification of the appeals process.